We have the tools to help protect our members.

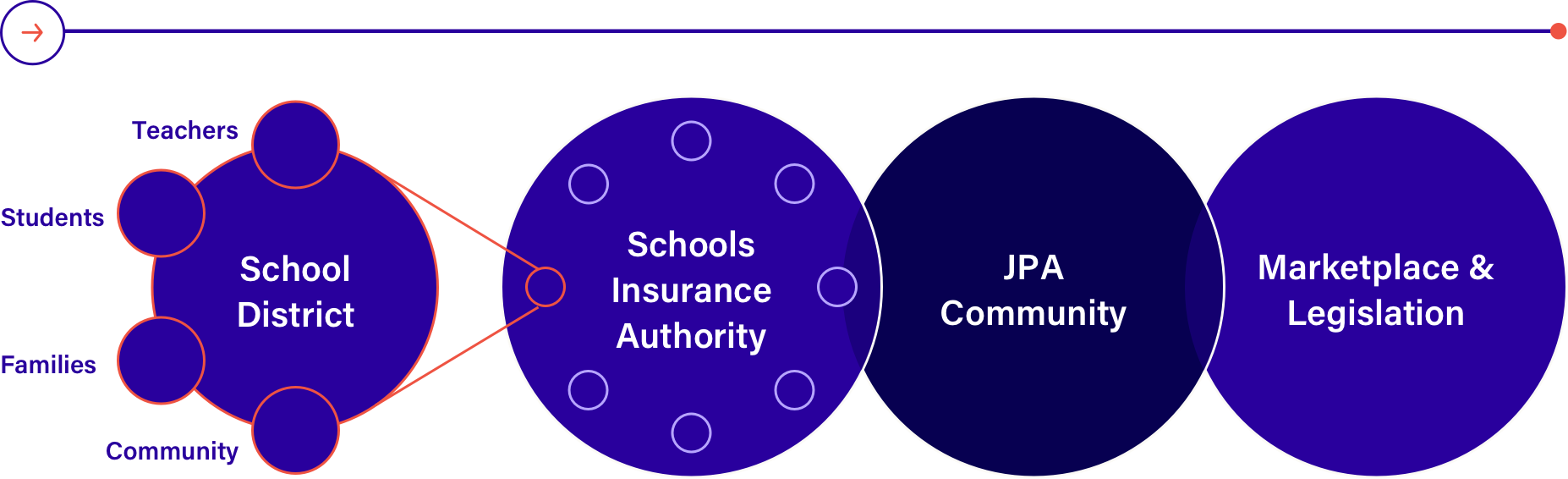

Schools Insurance Authority (SIA) is a Joint Powers Authority dedicated to meeting the risk management and risk financing needs of its membership.

Schools Insurance Authority (SIA) is a Joint Powers Authority dedicated to meeting the risk management and risk financing needs of its membership.

For our member school districts, stable and reasonable insurance costs are maintained through smart risk pooling techniques, effective prevention services, joint purchasing of services, and the development of necessary programs that serve to protect the people in our membership and our members’ assets. We partner with our members to help them be successful in preventing workplace injuries, property loss and maintaining safe and strong school environments for students and employees.

To protect the human and financial resources of our member school districts in order to assure continuation of the educational process by:

In the early 1970s, public agencies were faced with rising insurance costs and few coverage options. Sacramento County school districts were among those affected. The Sacramento County Grand Jury charged the Sacramento County Office of Education with the responsibility of studying this problem and seeking ways to implement a county-wide insurance program.

The County Office of Education invited each school district to send a representative to serve on a task force to research this insurance issue. The decision was made to establish a self-insurance pool to cover common property losses and to purchase excess insurance to cover catastrophic losses.

In the mid-1970s, the California Legislature amended the Government Code to provide that any two or more public agencies could join together to exercise jointly any rights they might individually have, creating the first Joint Powers Agreement, enabling Sacramento County school districts to pool together for the purpose of self-insurance. Under these codes, Schools Insurance Authority (SIA), originally named Sacramento Insurance Authority, was formed on July 1, 1974 making it the oldest joint powers authority (JPA) in California.

SIA was committed to saving insurance premium dollars for school districts and stabilizing the cost of insurance over the long period. The original five charter members participating were San Juan Unified School District, Natomas Unified School District, Del Paso Heights School District, Elk Grove Unified School District and Sacramento County Office of Education.

The first program implemented in 1974 was the Property Program, followed by the Liability Program in 1975, the Workers’ Compensation Program in 1977 and in 1980, the Benefits Program. In 1980 SIA also hired its first employee, Joseph Farrell, as Executive Director.

Today SIA has a total of 37 members, representing school districts, county offices of education and joint powers authorities, all located in Northern and Central California. Although not all members participate in all programs, it is through the joining together for the purpose of self-insuring, group purchase, loss control and greater financial resources, that continued stabilization of insurance costs will be maintained for school districts who participate in Schools Insurance Authority programs.

SIA’s Board of Directors is comprised of representatives from our participating members listed below, including: school districts, county offices of education and other joint powers authorities. The Board of Directors delegates authority to a 13-member Executive Committee, which meets regularly with SIA’s Executive Director and management staff to address specific policy issues and oversee the business of the JPA. Standing committees serve the Executive Committee and include Personnel, Budget, Audit and Nominating. In addition, ad hoc committees are created as needed to advise the Executive Committee on issues of interest and concern.

There are many different reasons you may need to connect with our team. Get in touch with us directly, or follow the prompts for claims and work-related injuries to get the support you need.